Invest in a Safer, Healthier Future Through Rapid Testing Technology.

The MiQLab® system fully automates gold standard chemistry (PCR) to provide rapid and precise pathogen detection. Ours is the only broad spectrum technology that can detect contamination through all stages of the manufacturing process.

Accredited Investor Opportunity

$10,000

Minimum Investment

$1.03

Share Price

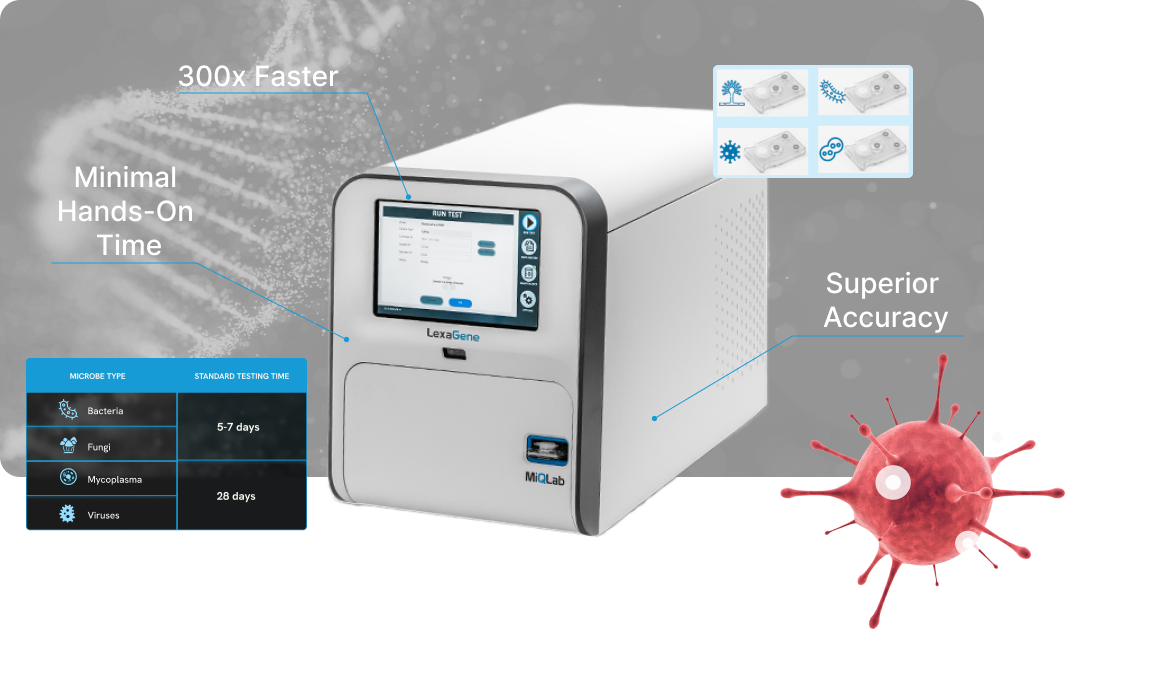

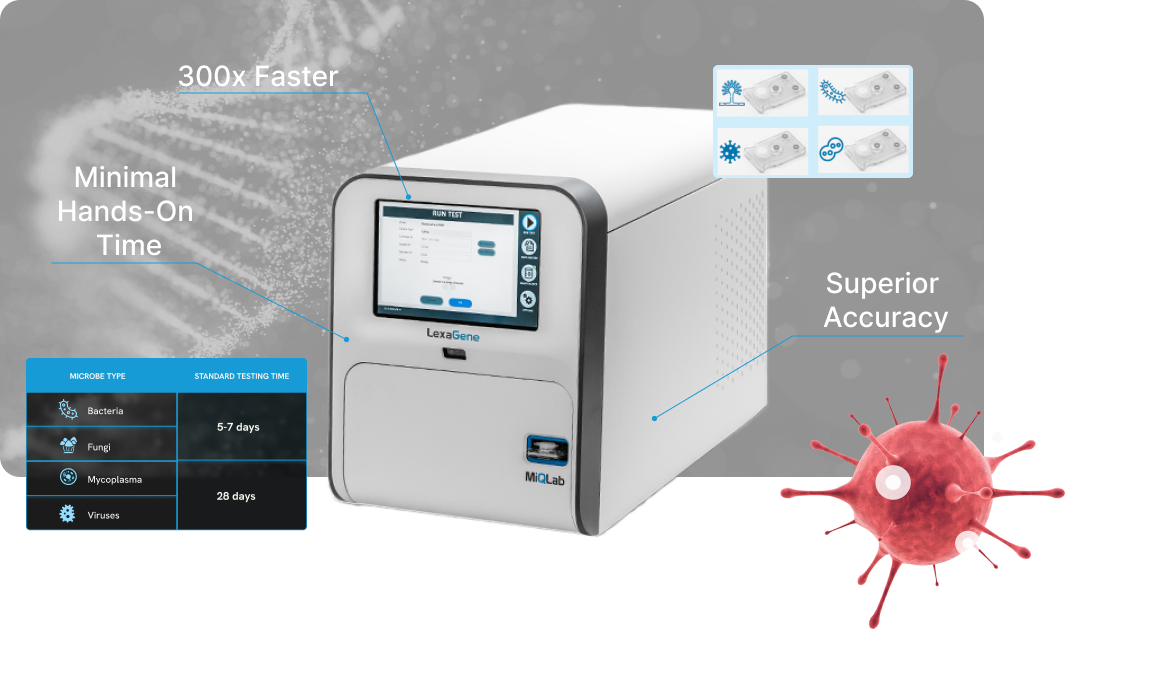

300x Faster

Than current standard testing processes using our rapid PCR system.

Safer for You

Our highly accurate testing system supports safe and consistent availability of medicines and products.

$2B Market

A $1.5B consumables TAM and a $500M testing device TAM are our initial biopharma markets.

Learn how LexaGene is delivering critical answers in less time.

Outdated Testing Jeopardizes Patients and Profits.

Slow, error-prone manual testing increases risks of contaminated drugs harming consumers and manufacturers bearing steep costs from detected lot failures, plant decontamination, regulatory fines and more. This underperforming system impacts consumer safety and company profitability.

“Bioburden (Contamination) is the number one bottleneck we have to achieving real-time release.”

– Head of Process Analytical Technology at leading biopharma manufacturer –

Introducing the MiQLab® System:

A New Frontier in Rapid

Contamination Testing.

The testing system manufacturers want and consumers need.

The MiQLab® system fully automates gold standard chemistry (PCR) to provide rapid and precise pathogen detection. Capable of detecting up to a broad range of targets simultaneously, MiQLab® serves a wide range of applications—from biopharmaceuticals to food safety and custom testing markets that demand quick, reliable answers.

Experience the Golden Age of Pathogen Detection.

The MiQLab® system represents a fundamental rethinking of how drug manufacturers detect contaminants to safeguard product quality. Its innovative technology combines multiplexed PCR detection capabilities with an automated, streamlined workflow.

MiQLab® is the modern solution manufacturing quality teams need. It combines unrivaled speed, accuracy and simplicity to thoroughly detect threats before they impact drug quality, consumer safety or manufacturers’ bottom lines.

Get the LexaGene Investor Deck.

Capturing a $2B Opportunity in Rapidly Growing Biopharma.

Biologics manufacturers urgently need better quality control testing to meet booming demand as biologics sales are projected to nearly double by 2029. We’re focused here first, but our technology opens doors to multi-billion dollar verticals like veterinary, food safety and more.

Top Biopharma Groups Give

LexaGene Their Stamp of Approval

Feasibility studies have already been performed with two multi-billion dollar biopharma giants, fast-tracking adoption by demonstrating how our system meets their rigorous standards. LexaGene’s credibility is further bolstered by having multiple MiQLab® systems successfully deployed in veterinary care settings. With these key relationships and proven deployments, we have a head start bringing modern contamination testing to major industry players.

Trailblazing the Path to $60M+ in Annual Recurring Revenue

Testing Device

$75,000/unit

Consumables & Services

$150/cartridge

82.5%

Recurring Revenue by 2029

672%

YoY Growth 2026-2027

73%

Margin by 2029

Unrivaled in Speed, Precision, and Ease-of-Use.

While competitors attempt to replicate LexaGene’s technology, they’ll struggle to match our system’s unparalleled capabilities. The MiQLab® delivers rapid pathogen detection at a rate of 2 hours per test – up to 300x faster than current methods, with exceptional accuracy capable of detecting multiple targets simultaneously. Testing with the MiQLab® requires less than 1 minute of hands-on time; no specialized training needed.

Decades of Biopharma Expertise

Leading the Charge

LexaGene was founded in 2016 to develop the first MiQLab system to serve the veterinary medicine sector. In 2023, LexaGene was acquired by the company’s largest shareholder, Meridian Capital, to focus exclusively on serving the biopharma industry. This provided a clean slate with a single shareholder – there are no existing preferred shares or notes in our cap table.

Tom Forte

CEO

David Ronck

CFO

Jack Rengan,PhD

Founder & CTO

Odis Pirtle

Strategic Avisor

Curt Boisfontaine

COO

Streamlined Product

Roadmap to Revenue.

Capital Raise

Objective: Secure funds to develop the Gen2 MiQLab system and establish key partnerships.

Outcome: Capital accelerates product development, supports early relationships with key customers, and advances LexaGene’s mission to transform biopharmaceutical testing.

”Product

Objective: Create the Gen2 MiQLab system, supported by a team of engineers and biologists.

Outcome: Beta product in customers’ hands, leading to higher valuation for future capital raises and deeper sales conversations.

”Customer

Objective: Create a system that meets key customers’ needs and workflows.

Outcome: Early adoption, broader

commercialization, a rapid selling cycle and contracts with key customers should drive significant valuation upside once sales begin.

Join our mission:

Invest in modernizing drug manufacturing.

FAQ.

What’s your share price?

$1.03/share

What is the minimum investment size?

The minimum investment size for this current round is $10,000.

Why should I invest?

The MiQLab® System is a disruptive technology that has the potential to revolutionize the molecular diagnostics industry. It is significantly faster and more affordable than traditional PCR-based systems, making it more accessible to a wider range of users. LexaGene has a strong management team with a proven track record of success in the molecular diagnostics industry. The creator of the technology, Dr. Jack Regan, is a highly respected scientist with over 20 years of experience in the field.

How will LexaGene make money?

Biopharma customers will put four of our systems on one of their production lines. We sell systems for $75k, and consumable cartridges for $150. We expect to generate $246k in consumables revenue for each device sold. A single production line sale could equate to about $1M in recurring consumable revenue. Many of our customers have 40-100+ lines.

How do I know people will buy this solution?

Two biopharma manufacturers have already performed feasibility studies on the MiQLab system and continue to consider implementation.

Are there more opportunities ahead?

They are still in the early stages of commercializing this breakthrough. Plus there is a future opportunity to expand into human medical diagnostics.

What perks do I get for investing?

The shares of stock carry a liquidation preference – meaning the shares receive the first cash to be distributed to shareholders from operations or from a capital event in order to return the initial investment made by the shareholder. This liquidation preference results in shareholders receiving priority distributions before any other class of investor.

How do I get a return on my investment?

Investing in startups is risky and there is no guarantee you will get a return on your investment. However, an exit opens up the opportunity where you could convert your shares into cash or a more liquid asset. Exits include going public, getting acquired by a larger company, or our company buying back shares. If the value of our company grows, then you have a higher potential of making a profit on your investment during one of these exits. You are investing in a pre-revenue company. Success will be measured in progress towards revenue. Future liquidation events could include acquisition or an IPO.

When will I receive my shares?

Shares will be awarded after the investment funds clear. This typically takes around 3 weeks after investment.

Are there higher fees if you invest via credit card vs. ACH?

No, costs are the same, regardless of how you invest.

Will you be paying out dividends to investors?

No

What are Preferred Liquidation Rights?

As an investor, you are purchasing common stock of LexaGene Life Sciences CF Investors, Inc. which will make a capital investment in LexaGene Life Sciences, LLC in exchange for Class A Common Membership Units not to exceed 12.5% of total ownership. Your Class A Common Membership Units provide you with a liquidation preference over other capital previously contributed to LexaGene Life Sciences. Meaning any cash generated by LexaGene Life Sciences, LLC, either from operations or from a capital event will FIRST go to repay all class A Common Membership Units initial investment before any other investors receive cash distributions.

Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns.

DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, located at 105 Maxess Road, Suite 124, Melville, NY 11747, is the Intermediary for this offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA’s BrokerCheck. DealMaker Securities LLC does not make investment recommendations. DealMaker Securities LLC is NOT placing or selling these securities on behalf of the Issuer.

Invest in a Safer, Healthier Future Through Rapid Testing Technology.

The MiQLab® system fully automates gold standard chemistry (PCR) to provide rapid and precise pathogen detection. Ours is the only broad spectrum technology that can detect contamination through all stages of the manufacturing process.

Accredited Investor

Opportunity

$10,000

Minimum Investment

$1.03

Share Price

300x Faster

Than current standard testing processes using our rapid PCR system.

Safer for You

Our highly accurate testing system supports safe and consistent availability of medicines and products.

$2B Market

A $1.5B consumables TAM and a $500M testing device TAM are our initial biopharma markets.

Learn how LexaGene is delivering critical answers in less time.

Outdated Testing Jeopardizes Patients and Profits.

Slow, error-prone manual testing increases risks of contaminated drugs harming consumers and manufacturers bearing steep costs from detected lot failures, plant decontamination, regulatory fines and more. This underperforming system impacts consumer safety and company profitability.

“Bioburden (Contamination) is the number one bottleneck we have to achieving real-time release.”

– Head of Process Analytical Technology at leading biopharma manufacturer –

Introducing the MiQLab® System:

A New Frontier in Rapid

Contamination Testing.

The testing system manufacturers want and consumers need.

The MiQLab® system fully automates gold standard chemistry (PCR) to provide rapid and precise pathogen detection.

Capable of detecting up to a broad range of targets simultaneously, MiQLab® serves a wide range of applications—from biopharmaceuticals to food safety and custom testing markets that demand quick, reliable answers.

Experience the Golden Age of Pathogen Detection.

The MiQLab® system represents a fundamental rethinking of how drug manufacturers detect contaminants to safeguard product quality. Its innovative technology combines multiplexed PCR detection capabilities with an automated, streamlined workflow.

MiQLab® is the modern solution manufacturing quality teams need. It combines unrivaled speed, accuracy and simplicity to thoroughly detect threats before they impact drug quality, consumer safety or manufacturers bottom lines.

Get the LexaGene Investor Deck.

Capturing a $2B Opportunity in Rapidly Growing Biopharma.

Biologics manufacturers urgently need better quality control testing to meet booming demand as biologics sales are projected to nearly double by 2029. We’re focused here first, but our technology opens doors to multi-billion dollar verticals like veterinary health, food safety and more.

Top Biopharma Groups Give

LexaGene Their Stamp of Approval

Feasibility studies have already been performed by two multi-billion dollar biopharma giants, using our Gen1 Platform fast-tracking adoption by demonstrating how our system meets their rigorous standards. These companies support the development of our technology. LexaGene’s credibility is further bolstered by having multiple MiQLab® systems successfully deployed in veterinary care settings. With these key relationships, we have a head start bringing modern contamination testing to major industry players.

Trailblazing the Path to $60M+ in Annual Revenue

LexaGene’s business model provides a combination of upfront instrument revenue and highly lucrative recurring consumables sales. With robust product gross margins over 80% on LexaGene’s single-use test cartridges, the model quickly scales as adoption grows.

Testing Device

$75,000/unit

Consumables & Services

$150/cartridge

82.5%

Recurring

Revenue by 2029

672%

YoY Growth

2026-2027

73%

Gross Margin by 2029

Unrivaled in Speed,

Precision, and Ease-of-Use.

While competitors attempt to replicate LexaGene’s technology, they’ll struggle to match our system’s unparalleled capabilities. The MiQLab® delivers rapid pathogen detection at a rate of 2 hours per test – up to 300x faster than current methods, with exceptional accuracy capable of detecting multiple targets simultaneously. Testing with the MiQLab® requires less than 1 minute of hands-on time; no specialized training needed.

Decades of Biopharma Expertise Leading the Charge.

LexaGene was founded in 2016 to develop the first MiQLab system to serve the veterinary medicine sector. In 2023, LexaGene was acquired by the company’s largest shareholder, Meridian Capital, to focus exclusively on serving the biopharma industry. This provided a clean slate with a single shareholder – there are no existing preferred shares or notes in our cap table.

Tom Forte

CEO

Odis Pirtle

Strategic Avisor

Jack Regan, PhD

Founder & CTO

David Ronck

CFO

Curt Boisfontaine

COO

Streamlined Product

Roadmap to Revenue.

Capital Raise

Objective: Secure funds to develop the Gen2 MiQLab system and establish key partnerships.

Outcome: Capital accelerates product development, supports early relationships with key customers, and advances LexaGene’s mission to transform biopharmaceutical testing.

Product Development

Objective: Create the Gen2 MiQLab system, supported by a team of engineers and biologists.

Outcome: Beta product in customers’ hands, leading to higher valuation for future capital raises and deeper sales conversations.

Customer Mapping and Relationships

Objective: Create a system that meets key customers’ needs and workflows.

Outcome: Early adoption, broader

commercialization, a rapid selling cycle and contracts with key customers should drive significant valuation upside once sales begin.

Join our mission:

Invest in modernizing drug manufacturing.

FAQ.

What’s your share price?

$1.03/share

What is the minimum investment size?

The minimum investment size for this current round is $10,000.

Why should I invest?

The MiQLab® System is a disruptive technology that has the potential to revolutionize the molecular diagnostics industry. It is significantly faster and more affordable than traditional PCR-based systems, making it more accessible to a wider range of users. LexaGene has a strong management team with a proven track record of success in the molecular diagnostics industry. The creator of the technology, Dr. Jack Regan, is a highly respected scientist with over 20 years of experience in the field.

How will LexaGene make money?

Biopharma customers will put four of our systems on one of their production lines. We sell systems for $75k, and consumable cartridges for $150. We expect to generate $246k in consumables revenue for each device sold. A single production line sale could equate to about $1M in recurring consumable revenue. Many of our customers have 40-100+ lines.

How do I know people will buy this solution?

Two biopharma manufacturers have already performed feasibility studies on the MiQLab system and continue to consider implementation.

Are there more opportunities ahead?

They are still in the early stages of commercializing this breakthrough. Plus there is a future opportunity to expand into human medical diagnostics.

What perks do I get for investing?

The shares of stock carry a liquidation preference – meaning the shares receive the first cash to be distributed to shareholders from operations or from a capital event in order to return the initial investment made by the shareholder. This liquidation preference results in shareholders receiving priority distributions before any other class of investor.

How do I get a return on my investment?

Investing in startups is risky and there is no guarantee you will get a return on your investment. However, an exit opens up the opportunity where you could convert your shares into cash or a more liquid asset. Exits include going public, getting acquired by a larger company, or our company buying back shares. If the value of our company grows, then you have a higher potential of making a profit on your investment during one of these exits. You are investing in a pre-revenue company. Success will be measured in progress towards revenue. Future liquidation events could include acquisition or an IPO.

When will I receive my shares?

Shares will be awarded after the investment funds clear. This typically takes around 3 weeks after investment.

Are there higher fees if you invest via credit card vs. ACH?

No, costs are the same, regardless of how you invest.

Will you be paying out dividends to investors?

No

What are preferred liquidation rights?

As an investor, you are purchasing common stock of LexaGene Life Sciences CF Investors, Inc. which will make a capital investment in LexaGene Life Sciences, LLC in exchange for Class A Common Membership Units not to exceed 12.5% of total ownership. Your Class A Common Membership Units provide you with a liquidation preference over other capital previously contributed to LexaGene Life Sciences. Meaning any cash generated by LexaGene Life Sciences, LLC, either from operations or from a capital event will FIRST go to repay all class A Common Membership Units initial investment before any other investors receive cash distributions.

Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns.

DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, located at 105 Maxess Road, Suite 124, Melville, NY 11747, is the Intermediary for this offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA’s BrokerCheck. DealMaker Securities LLC does not make investment recommendations. DealMaker Securities LLC is NOT placing or selling these securities on behalf of the Issuer.